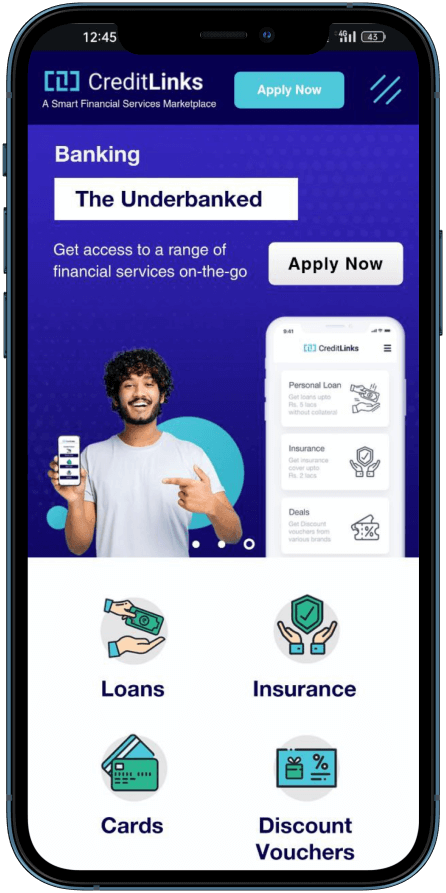

CreditLinks

Your One-Stop for Instant Personal Loan In India with No Collateral

CreditLinks is your trusted partner when it comes to finding the personal loan that suits your individual needs. This platform simplifies the loan search process, making it easy for you to discover the best personal loan options available.

Best Personal Loan App for Urgent Situations

Key Features Of CreditLinks

Smart Financial Insights

Gain access to valuable insights and recommendations that empower you to make informed financial decisions. The advanced algorithms analyze your financial profile to match you with the most suitable plans and services.

Diverse Marketplace

Explore a wide range of financial products and services, including loans, credit cards, insurance, investments, and more, all in one place. Discover options you may have never considered before.

Simplified Comparison

Easily compare offers from top financial institutions and service providers. We present the options in a clear, straightforward manner, so you can choose the best solution with confidence.

Secure and Convenient

CreditLinks is designed with robust security measures to protect your personal and financial information. Plus, it's user-friendly and accessible from anywhere.

Personalized Guidance

CreditLinks provides you with personalized financial guidance to help you achieve your goals, whether it's securing a loan, optimizing your investments, or finding the perfect insurance coverage.

Personalized Guidance

CreditLinks provides you with personalized financial guidance to help you achieve your goals, whether it's securing a loan, optimizing your investments, or finding the perfect insurance coverage.

How It Works

Ready to embark on a smarter personal loan journey? Sign up for CreditLinks now and experience a world of personalized loan solutions at your fingertips. Your financial goals are within reach with CreditLinks as your trusted financial service marketplace.

Create

Your Profile

Create Your Profile

Get started by creating a profile and sharing some basic information. They take privacy seriously and use your data to provide you with tailored financial recommendations.

Receive Recommendations

The powerful algorithms analyze your profile and financial goals to provide you with recommendations that match your unique needs.

Apply and Secure Your Future

Once you’ve found the perfect fit, complete your application directly through the platform. Start on the path to financial success with confidence.

Explore and Compare

Browse the diverse marketplace, compare offers, and read informative content to make an informed decision.

Why Choose CreditLinks for Personal Loans?

Extensive Loan Options

CreditLinks provides access to a wide array of personal loan options. Whether you’re interested in secured or unsecured loans, short-term or long-term financing, the platform connects you with a diverse range of lenders, ensuring you can find a loan that matches your requirements.

Educational Resources

Financial literacy is key to making sound financial decisions. CreditLinks equips you with educational resources, articles, guides, and tools to enhance your financial knowledge, ensuring you have the information you need to make the right choices

Secure and Confidential

CreditLinks employs advanced encryption and security measures to protect your personal information. Rest assured that your data is safe and confidential when you use the platform to explore personal loan options.

Streamlined Comparison

CreditLinks simplifies the loan comparison process. No more endless web searches and multiple browser tabs. You can easily compare loan terms, interest rates, and other essential details, all in one place. This empowers you to make an informed choice that best aligns with your financial goals.

Personalized Loan Solutions

CreditLinks is committed to offering personalized loan solutions as per your needs. The platform takes your financial profile into account, helping you find loans tailored to your credit score, income, and borrowing needs.

How CreditLinks Works for Personal Loans?

Loan Search

Begin by entering your loan preferences and financial information. CreditLinks uses this data to match you with suitable loan options.

Application

Once you’ve found the right loan, you can apply directly through CreditLinks. The application process is simple and secure, helping you move one step closer to securing your loan.

Loan Comparison

Browse through the list of matched personal loan offers. Compare interest rates, terms, and other key details to identify the best fit for your needs.

Approval and Funding

After submitting your application, the lender will review your request and, upon approval, provide you with the funds you need to meet your financial goals.

Repayment

Your chosen lender will outline the repayment terms, which may include monthly installments. You can manage your loan conveniently through your lender’s provided tools and resources.

Don't let the search for a personal loan be a daunting task. CreditLinks is here to help you find the right loan tailored to your specific needs. Start exploring the platform today, and take control of your financial future with confidence.

Advantages of Choosing Personal Loan Over Other Loans in India

Choosing a personal loan over other types of loans in India offers several advantages, depending on your specific financial needs and circumstances. Here are some key advantages of opting for a personal loan:

Versatility

Personal loans are incredibly versatile and can be used for a wide range of purposes, such as home renovations, medical expenses, education, debt consolidation, weddings, travel, or even emergencies. There are no restrictions on how you can use the funds.

No Collateral Required

Personal loans in India are typically unsecured, meaning you don’t need to provide collateral, such as property or assets, as security. This reduces the risk of losing valuable assets in case of loan default.

Quick Approval and Disbursement

Many lenders in India offer a quick and streamlined approval process for personal loans. Once approved, the funds are usually disbursed swiftly, making it an ideal choice for addressing immediate financial needs or emergencies.

Fixed Interest Rates

Personal loans often come with fixed interest rates, ensuring that your monthly repayments remain stable throughout the loan tenure. This predictability makes budgeting easier and more manageable.

Debt Consolidation

Personal loans are commonly used in India for consolidating high-interest debts, such as credit card balances. By consolidating debts, you can potentially lower your overall interest payments and simplify your financial obligations.

Credit Building

Successfully repaying a personal loan can positively impact your credit score in India. It demonstrates responsible financial behavior and contributes to the development of a strong credit history, which can be valuable for future financial transactions.

No Usage Restrictions

You have complete freedom in how you use the loan amount, whether it’s for major purchases, medical expenses, education, or even leisure activities.

Shorter Tenure

Personal loans often come with shorter repayment tenures compared to other types of loans like home loans or car loans. This can be advantageous if you prefer to pay off your debt relatively quickly.

Online Application

Many banks and financial institutions in India offer the convenience of applying for a personal loan online, making the process faster and more accessible.

No Asset Risk

Since personal loans are unsecured, there’s no risk of losing assets in the event of loan default, unlike secured loans such as home loans or auto loans.

It’s important to consider the terms, interest rates, and fees associated with personal loans from different lenders in India. The eligibility criteria, loan amount, and interest rates can vary based on factors such as your credit score, income, and the lender’s policies. Before choosing a personal loan, it’s advisable to compare various offers and consult with financial experts to ensure that it aligns with your financial goals and ability to repay the loan.

Get an Instant Personal Loan up to 5Lacs With No Collateral

Take Their Word For It

At CreditLinks, the team of experts understands that actions speak louder than words. So, take a moment to hear what the customers have to say about their personal loan experiences with CreditLinks. Their commitment to delivering the best personal loan solutions and exceptional service is exemplified by the testimonials from their satisfied customers:

These reviews reflect the positive experiences of customers. We suggest you experience the CreditLinks difference for yourself. Go for CreditLinks for your personal loan needs and embark on a financial journey supported by a team dedicated to making your financial goals a reality.

Sign in Today to Experience the Best Instant Loan Approval Journey and Lightening Speed Disbursal with CreditLinks

Frequently Asked Questions (FAQ)

CreditLinks is a digital platform that connects individuals with a variety of lenders to provide instant personal loans without requiring collateral. They offer personalized loan options, easy comparison tools, and educational resources to help you make informed financial decisions.

Eligibility for a personal loan through CreditLinks typically depends on several factors including your credit score, income level, employment status, and age. We serve a diverse range of borrowers, and you can quickly check your eligibility by creating a profile on our platform.

Personal loan amounts can vary based on your individual creditworthiness and the lender’s policies. Through CreditLinks, you can apply for personal loans up to 5 lakhs INR, depending on your eligibility.

The necessary documents may include government-issued ID proof, address proof, income/employment verification, and recent bank statements. Specific requirements may vary by lender.

CreditLinks streamlines the loan approval process. Once you submit your application, approval can be as quick as 24 hours, followed by a prompt disbursement by the lender, subject to their terms and conditions.

Interest rates for personal loans vary by lender and are influenced by your credit score, loan amount, and repayment tenure. CreditLinks helps you compare different lenders to find the most competitive rates available to you.

Yes, personal loans obtained through CreditLinks can be used for any personal expense, from debt consolidation to home renovations, education fees, medical emergencies, weddings, and more.

Your repayment schedule will be determined by the agreement with your lender. Typically, personal loans are repaid in monthly installments over a set period of time, which you can manage through your lender’s tools and resources.

Absolutely. CreditLinks employs advanced encryption and security protocols to ensure that your personal and financial information remains confidential and secure.

CreditLinks offers a variety of loan options for different credit profiles. Even with a poor credit score. They will connect you with lenders who can provide loan offers tailored to your situation. Additionally, they provide resources to help improve your creditworthiness.

CreditLinks provides a free platform to compare loan options. They do not charge users any fees for searching and applying for loans through the site. Any fees associated with the loan will be from the lenders and should be disclosed during the application process.

The customer service team is available to answer any additional questions you may have. You can reach the team through the contact information provided on their website or through their customer service portal.