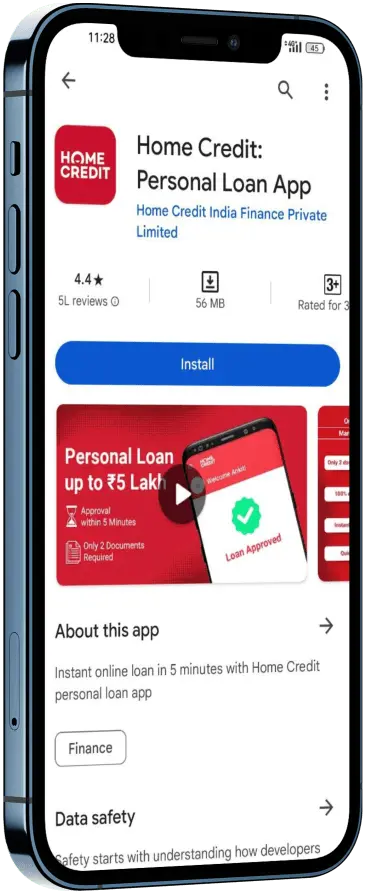

Home Credit Loan App

Home Credit stands as one of India’s leading personal loan apps, with over 1.6 Crore+ satisfied customers and counting. The app is dedicated to deliver quick, easy, and reliable financial solutions right at your fingertips.

Instant Personal Loan App You Can Trust

Meet all Your Financial Needs With Best Personal Loan App In India

Home Credit is not just a loan app; it’s a companion that empowers you to manage your financial needs with absolute ease. They provide a stress-free financial service with personal loans reaching up to ₹5 lakhs, suitable for a variety of needs of millions in India, such as dream vacations, educational courses, or unforeseen medical costs. Their process prides itself on minimal paperwork, exceptional flexibility, and expeditious disbursement of funds.

The Loan You Need, When You Need It

Our digital doors are open to a vast range of personal loans – from ₹1,000 to a substantial ₹5,00,000. Whether it’s for education, home renovation, or an emergency, they ensure your needs are covered instantly and efficiently.

Seamless Service Across India

With an expansive presence in over 600+ cities, their services are just a click away, no matter where you are. Home Credit is synonymous with trust and convenience, making us your reliable partner in the world of online loans.

Fulfill your Financial Needs within Minutes, all from the Comfort of your Home

Simple Steps to Avail A

Personal Loan of Up to ₹5,00,000

Check Your Eligibility

Enter your number, follow the prompts, and know your eligibility in an instant.

Flexible Loan Options

Choose from a wide range of loan amounts to suit your unique needs.

Rapid Disbursal

Complete the process and have the funds in your account in just a matter of hours.

Why Make Home Credit Your First Choice?

Speedy and Streamlined

Apply on-the-go and receive approvals at lightning speed.

Money in Minutes

After approval, the disbursal is just as fast, getting you the money when you need it most.

Instant Approval, No Waiting

Real-time processing to meet instant online approval, no delays.

Clarity and Comfort

With no collateral requirements and a no-hidden-fee promise, they ensure a comfortable loan experience.

Real Stories, Real Satisfaction: Customers Share Their Home Credit Experiences

Ready for a worry-free loan experience? Download the Home Credit app now and join the millions who trust it for their personal loan needs. Your journey towards financial flexibility starts here!

Apply Now for Instant Loans Up To ₹5,00,000 With Home Credit Digital Application With Quick Disbursals Within 2 Hours

Frequently Asked Questions

Home Credit is a leading personal loan app in India, offering quick and convenient personal loans up to ₹5,00,000 with a 100% online application process. They serve over 1.6 Crore+ customers across 600+ cities in India.

You can apply for a loan directly through the Home Loan app. Start by checking your eligibility with just your phone number, then follow the simple application process. If eligible, you can receive instant approval and have the funds disbursed within hours.

The basic criteria include being an Indian citizen, having a steady source of income, and being within the age bracket defined in the app. For more detailed information, please refer to the eligibility section on the app or website.

You only need two documents to apply for a loan with Home Credit: a government-issued ID proof and an address proof.

You can apply for personal loans ranging from ₹1,000 to ₹5,00,000, depending on your eligibility and creditworthiness.

Loan applications can be approved within just 5 minutes after submission, provided all the required information and documents are in order.

Once your loan is approved and the agreement is signed, the loan amount will be disbursed to your bank account within a few hours.

No, Home Credit offers collateral-free personal loans. There are also no hidden charges; everything is transparent.

Repayment can be made through various modes, including online transfers, EMI options on the app, and other available payment methods listed on their platform.

Yes, you can prepay your loan. For details on prepayment charges, please check the terms and conditions on the app or speak with their customer service team.

The customer support team is always ready to assist you. You can reach out through the app’s support section or contact us via the helpline numbers provided on the website.

Absolutely. The app takes your privacy seriously and uses robust security measures to ensure your personal information is protected according to the highest standards.