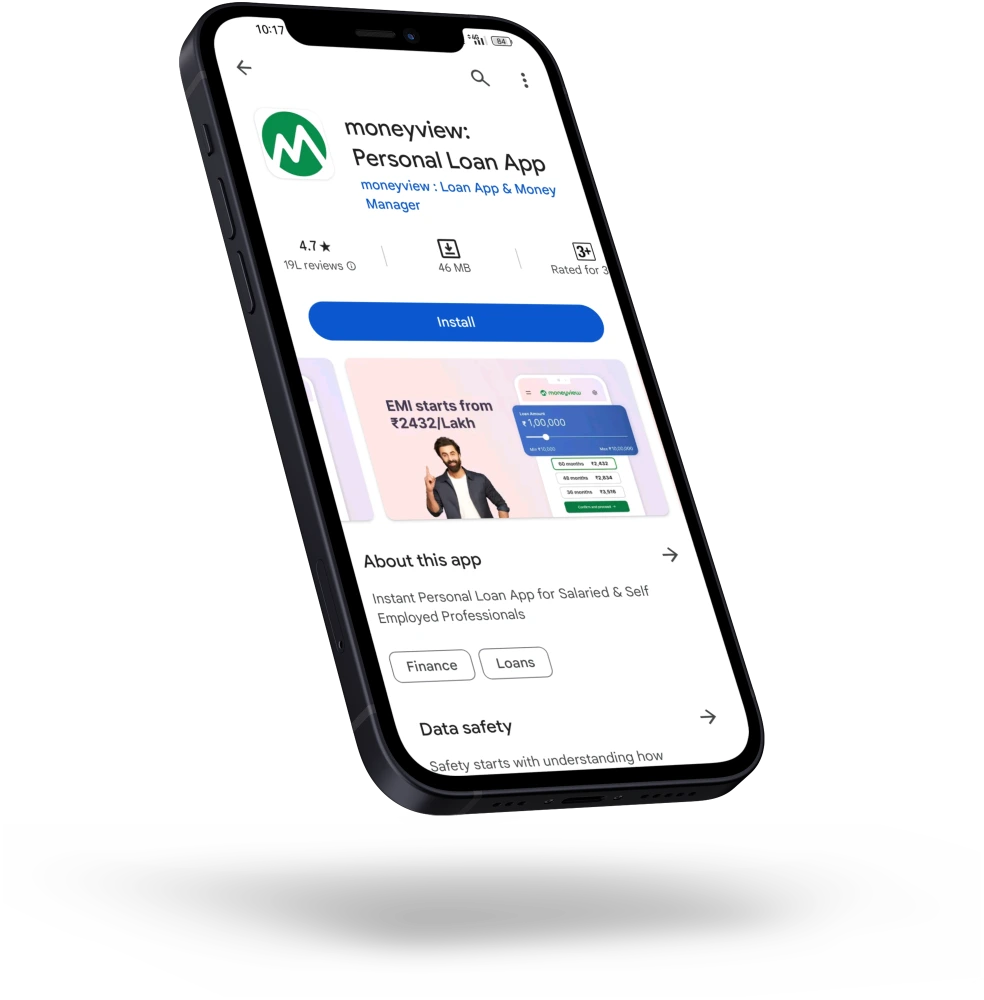

Moneyview Loan App

Moneyview

Loan App

Instant Personal Loans for Every Need

Moneyview Personal Loan App offers you the convenience of obtaining a personal loan up to ₹10,00,000 instantly, all from the comfort of your home. Whether it's for an emergency, a special occasion, or need to consolidate debt, Moneyview is here to help.

Key Features

High Loan Limit

Borrow up to ₹10,00,000 for your diverse needs.

Transparent and Honest

Absolutely no hidden fees or surprise charges.

Flexible Interest Rates

Annual Percentage Rates (APR) range from a competitive 16% to 39%*.

Customizable EMI Plans

Choose repayment plans as per your convenience, ranging from 3 months to 5 years.

Quick, Simple, and Hassle - free Process Easy Application

Easy Application

Start your loan application process directly from your smartphone.

Flexible Loan Options

Tailor your loan amount and repayment schedule to fit your budget.

Quick Disbursement

Once approved, the loan amount is swiftly transferred to your account.

Accessible to Many

Whether you're salaried or self-employed, loans are designed for a wide range of applicants.

Easy Application Process

- Download the app

- Check eligibility in 2 mins

- Select loan amount & tenure

- Complete KYC and income verification

- Receive funds directly in your bank account

Why Choose Moneyview?

No Surprises, 100% Transparent

Transparency is the key in financial dealings, and at Moneyview, they take this seriously. You can check the interest rate, total repayment amount, and terms upfront. Their commitment to 100% transparency means you are fully informed, with no hidden fees or surprises.

Highest Loan Amounts Available

At Moneyview, they understand that everyone's financial needs are different. That's why they offer the highest loan amounts in the market, tailored to meet your specific requirements. Their innovative credit model ensures you receive the best personalized offer, making your financial goals more achievable than ever.

Most Affordable Offers

Why compromise on your financial plans when you can enjoy the most affordable offers with Moneyview? The flexible loan tenures range from 3 months to a generous 60 months. This flexibility allows you to choose a repayment plan that fits comfortably within your budget, making your loan experience stress-free.

Trusted by Millions

Moneyview's presence across India stands as a testament to its reliability and the trust it has built with its customers. Serving over 19,000 locations nationwide, Moneyview is committed to making loans accessible and straightforward for everyone, no matter where they are. This widespread reach underscores Moneyview's dedication to providing financial solutions that cater to the diverse needs of people across the country.

Hassle-Free, Easy to Use

Experience the seamless integration of human expertise and cutting-edge technology with the Moneyview app. The platform simplifies the loan process, making it quick, easy, and user-friendly. Say goodbye to lengthy processes and paperwork - a few taps on your phone, and you're on your way to securing a loan.

By The Numbers

Join a vast community of satisfied customers.

A track record of substantial loan distribution.

Extensive reach, ensuring availability across the country.

Moneyview is your go-to app for instant loans. Its easy-to-use platform, transparent terms, and flexible options, financial freedom is just a few taps away.

Get Instant Personal Loan From MoneyView

What the Customer Say About Moneyview App

Hear from the satisfied customers who’ve experienced the ease and convenience of Personal loan from Moneyview App.

Download the Moneyview Loan App now and join millions who have chosen a smarter way to get an instant personal loan.

Frequently Asked Questions (FAQ)

You can apply for loans up to ₹10,00,000 depending on your eligibility.

Our Annual Interest Rates (APR) vary from 16% to 39%, depending on various factors including your credit profile and loan tenure.

Loan approvals are typically quick. However, the exact time may vary based on your individual profile and documentation.

You can choose flexible EMI repayment plans ranging from 3 months to 60 months.

No, there are no hidden fees or charges. They believe in 100% transparency.

Yes, you can check your eligibility within the app in just 2 minutes.

You need to be aged between 21-57 years, have a minimum CIBIL score of 600 or Experian score of 650, and your income should be credited to a bank account.

Yes, the app uses 256-bit encryption and is designed to keep your data safe and secure.

You can repay your loan via EMIs. The details for repayment will be shared with you at the time of loan disbursement.

Yes, both salaried and self-employed individuals can apply for a loan with Moneyview.

You can reach out to their customer support at care@moneyview.in for any queries or assistance.

Missing an EMI can affect your credit score and may incur additional charges. It’s important to read the terms and conditions for details on late payments.

Yes, you can prepay your loan. Please check the app for terms related to prepayment.

Yes, the app is available in over 5000 locations across India and supports 8 languages.

Moneyview is unique due to its high loan amount offerings, flexible and affordable repayment options, complete transparency, and hassle-free application process.